If you’re anything like me a few years ago, you might struggle with saving money.

It seems like you only earn enough to cover your bills.

You always seem to live paycheck-to-paycheck, even if you do get a pay increase, or start to earn more money.

Maybe saving money isn’t a problem for you. Perhaps you struggle to build relationships. Either with finding a partner or making friends. It could be you often find yourself feeling alone in this world.

You may have no problem saving, have a loving partner and an awesome family. But, health and fitness are not your best friends.

You can’t run like you used to, or stairs aren’t as easy anymore. Every diet or exercise plan under the sun you’ve ever tried hasn’t worked for you. That gym membership’s looking a little rusty, you can’t remember the last time you regularly worked out, and hell, you didn’t really enjoy it anyway.

It could be it’s none of the above, but you’re really just NOT happy with your job.

You really wish you’d chosen a different path, or done your own thing. If only you could’ve started a business, you could have your own schedule and more freedom in your life.

But, those things are hard to get off the ground, and with everything you have going on now, you never have the time available to do it.

If you struggle with any of the things above, or even something different, I completely understand.

Trust me, I know this life well, I’ve been there…

The End of a Long Decade

In December 2019, we were at the end of a decade.

As usual, I looked at my life for the past 10 years, as a personal review.

When I did, I was absolutely shocked, and ashamed of what I saw in that review.

I started out the decade with a successful business, happy marriage, a life of fun and adventure, and everything was great.

But, everything had completely changed.

As I looked over the past decade I realized I’d done everything I was supposed to.

I worked hard (working 80-90 hour weeks was normal for me). I looked after my family, paid my bills, did my chores, took care of my yard, etc.

Only, when all was said and done, I had NOTHING to show for it.

Staring at the paper in front of me, it was crystal clear…

…I didn’t even have ONE DOLLAR to my name.

That scared the shit out of me.

10 Years with Nothing to Show For it

A decade of my life had gone by, and I had:

- ZERO dollars in savings

- No Business anymore

- Hadn’t been on a vacation in years

- Family life was hard (we had struggled financially for years)

- My fitness and health were declining

- I had absolutely no time to myself

After writing it all down and looking at it, I had no solutions.

I stared at it, trying to understand what I had to do to make a change. What should I stop doing? What can I do more of to improve? …I had nothing.

So I put it away.

Staring at it wasn’t helping, so I stopped looking at it.

I hoped some sort of sign would come to me, or a solution.

A few days later I was out walking, and it suddenly hit me like a lightning bolt.

I took off my headphones, stopped walking, and just said to myself out loud…

…’Oh my God! That’s IT!’

It was so simple, it almost couldn’t be true.

My Lightning Bolt Moment

I was out walking that morning, and remember being frustrated about my current situation.

It seemed no matter what I did, or what I tried, I always ended up back at zero again.

I kinda mumbled to myself under my breath..

“If my life was a business, it wouldn’t even be making a profit or a loss at this point. It would literally be running at a total net zero.”

That’s when it hit me.

It’s pretty much IMPOSSIBLE to run a business and produce a net zero result.

So I knee if I ran my life like a business, and treated things in my life with business principles, it would be impossible to fail.

THAT’S IT!!!

What’s a Net Zero?

A net zero is almost impossible to achieve in business. It’s kind of the dreaded result nobody would ever want.

It would mean for every penny the business took in, it spent the exact same amount, and ended up with zero profit, zero loss.

A net zero in business would be HORRIBLE.

A complete waste of time for everyone working there, including the ownership.

As a former CEO myself, when I thought about my life this way, I immediately knew what this meant.

It was totally AWESOME!!

The Best Opportunity Ever

If I took over a business that was bringing in money but making no profit, it would be the EASIEST thing to turn profitable, EVER.

I knew right away that if I looked at my life like it was a business, and made the right changes, I could turn it around EASILY!

So, I ran home and got to work immediately.

When I got back, I started to look at everything in my life like it was a business. I went to work cutting out all things that weren’t profitable, or took up too much of my time. I spent more time on things that have potential upside.

Knowing all I had to do was have ONE DOLLAR by the end of ten years, to make an improvement, took all the pressure off. So, I started saving each week / month. Even just small amounts of money. Who’s gonna notice $10.00 saved? It’s not as if it’s gonna kill my family to not have $10.00.

I started small, and made it easy. When you make something smaller, simpler, and easier, the goal isn’t impact, it’s habit forming. Once habits were formed, it all becomes A LOT easier.

A year later looking back the results were amazing!

Within 12 months, I had:

- $20,000 more income in 2020 than 2019

- $5,000.00 emergency fund

- $3,300.00 Stock Portfolio

- $700.00 in ‘secret savings’

- A happier family life

- Progress, success, and freedom

How was I able to turn this around so quickly, and so dramatically?

One of the first things I did, was look at many things in my life, as if they were bank accounts.

Your Bank Accounts

In a business you only really have financial bank accounts, but in life you actually have quite a few more.

Really, almost any part of your life can be considered a bank account.

In his legendary book 7 Habits of Highly Successful People, Stephen Covey wrote about emotional bank accounts. Emotional bank accounts are your personal, emotional investments in others. Time spent with family, favors done for friends, hanging out with relatives, etc.

Like Stephen said, the more time you invest with people, the more credits you build up, and the more they trust you, etc.

There are many types of bank accounts you may have in your life, and yours may be different to mine, but here’s a few bank accounts most people have, as examples:

Physical Bank Accounts

- Fitness & Health

- Exercise

- Diet / Eating

Mental Bank Accounts

- Wellness

- Emotional

- Stress

Relationship Bank Accounts

- Spouse / Partner / Marriage

- Children

- Friendships

- Relatives / Extended family

- Work Colleagues

Financial Bank Accounts

- Checking

- Savings

- Investments

- 401K

Knowledge & Skills Bank Accounts

- Musical Instrument

- Work related Skill

- Sales

- Web Design

Work Bank Accounts

- Work produced

- Sales

- Chores

- Errands

These accounts work in a similar way to any regular bank account. So, the more deposits you make, the more credits you build.

As you’re investing… those credits compound and grow.

This is exactly like cash in a savings account, or investment fund.

The problem is, the more withdrawals you make, the less you have. If you’re withdrawing or ignoring your investment it dwindles, fades, deteriorates, or just sits there doing nothing at all.

Relationship Bank Accounts

With people, the more you spend time with them, stay in contact, etc., the bigger and better your relationship and trust becomes with that person.

But, the less time you spend with them, the more likely they begin to forget about you, trust levels drop, etc.

You become less of a friend, with less frequent contact.

The more you invest in your relationships with other people, the more they grow, and the bigger the levels of trust get.

However, if you do something that person might be upset about, you’re making a huge withdrawal.

In this way, relationships with people are JUST LIKE investment accounts. The more you invest, the more the trust compounds over time. The less you invest, the more the value of the relationship declines.

Knowledge / Skill Based Bank Accounts

Knowledge and experience in a subject, topic, or skill works the same way.

If you don’t pick it up for a long time, you lose the ability / skill. At that point you might forget how to do it completely, and have to start over by relearning it.

But if you invest every day and stay focused, your ability, skill, and knowledge grow, and you can become a master at that thing.

Ignore your knowledge and skills, and either stop building them or using them, and they could even become outdated and useless in the marketplace.

Just like relationships, if you ignore your skills, and stop learning, you’ll get stale.

Stop doing / learning about something for long enough, and it’s no longer part of your life anymore.

Positive and Negative Investment

In a regular financial bank account, you can pretty much only invest more into it, or withdraw what you already have.

But in your life bank accounts, it’s equally possible to invest time and energy into the negative side.

Think about this like getting an overdraft, or loans, or borrowing money, creating debt, or negative outcomes from a bad investment.

As an example, when it comes to your health, you can invest in fitness, eat healthier food, and be more active. These are all positive adds.

But, if you drank alcohol everyday and became an alcoholic, were smoking, ate junk food, or all three… …now you’re investing MUCH more in the negative side.

As they say in health and wellness, ‘you can’t out exercise a bad diet’.

Similarly, financially it’s no good earning $500,000.00 a year, if you’re adding more negatives to the other side by getting a bigger house, nicer car, increasing debt, or have bad habits / addictions like gambling.

You can invest more in your negative side, and keep pushing and pushing, until you’ve completely ruined your life in this area.

This is the equivalent of taking yourself way beyond bankruptcy in the financial world.

Example of Negative Investment

I’m 48 years old today. My father was an alcoholic for my whole life, and even before I was born. He also was a smoker, and his diet wasn’t good, either.

Growing up, and even after I moved away from home… I watched my father invest everything he had in those things.

My father invested negatively for over 50 years.

As I write this, my father died just over a week ago. He was just 71 years old.

Retired at 65 years old, but within a year of retiring, he was diagnosed with vascular dementia.

Next thing we knew, he also had lung disease (COPD).

He was later diagnosed with AFIB.

Literally from almost the very moment he retired, he was unable to do anything physical, his memory was gone, and he was waiting to die.

My father worked hard his whole working life, and earned good money. But, he had no money for retirement.

He died 6 years after retirement, having done nothing in his retirement years, other than dying.

My father worked, invested for a lifetime in negative consequences, and died an early death.

Be Careful What you Invest In

My lesson in this observation of my father is that as you go through your life, you MUST understand that EVERY day, everything you do, is an investment in your future of some kind.

It can be a positive investment, or a negative one.

Either way, You’re ALWAYS investing in something.

You can either add a plus, or add a minus (subtract).

In equal amounts, these could cancel each other out.

You could spend as much as you make, live ‘paycheck to paycheck’ on everything in your life. This is a net zero game.

Never growing, never getting better, never making any progress, never figuring out where you’re going wrong. Just staying where you are, treading water, feeling stuck, not knowing the way out.

This is where I was, in December 2019 until I came up with the concept for No More Net Zeros.

I took a look at my life’s bank accounts, and figured out what needed to change.

That’s step one for you, too.

Positive and Negative Actions are Both Binary

When you win, you grow. You get better, and your life becomes an automatic winning machine.

At some point, things become smoother, almost automatic. Systems can also be put into place, and the growth becomes automatic.

Just like any regular business or personal finance account, the net value matters most.

It’s no good earning a million dollars a year, if you spend a million dollars and end up with a net zero.

You must take a look at your bank accounts frequently, and ask yourself… are you net positive, net negative, or at a net zero?

Ask yourself what can you tweak here and there, to increase ‘profits’.

Skills grow and compound, or regress and shrink, depending on whether you’re investing in them or not.

This is the same for your health, wealth, and relationships.

Just about anything in your life can be seen as a bank account.

So, let’s take a look at your bank accounts…

Take a Look at Your Bank Accounts

Step one, consider any areas of your life that you want to make improvement.

It doesn’t matter if you need to save more money, lose weight, get better socially, find a girlfriend / boyfriend, you name it.

Simply write down each area you need to improve. Then, consider each one a bank account.

Put together a list of bank accounts you need to work on.

How Can You Improve?

Next to each bank account (or under the title), write down your ideal outcome. You don’t have to be hyper-specific here, like a goal. It can be as simple as ‘lose weight’, ‘save money’, or ‘find more friends’.

As you look at each bank account, consider what you’re investing in currently.

Saving money might be hard because you eat out too often.

Maybe you spend too much every time you go to certain stores like Target / Costco (guilty as charged myself on both). Or maybe find that every time you save ANY money, an emergency comes up, and it gets wiped out.

You might be trying to get out of debt, but making the payments is killing you financially, or preventing you from saving.

Figure out what your levers are. What are the mechanics behind this issue, that make that bank account’s economy work?

Now that you know what those are, recognize them as binary issues you can change.

It’s a Matter of Ones and Zeroes

The most important thing to make lasting change, is that it needs to be easy, simple, and trackable, without even thinking about it.

Also recognize that as humans (especially myself), we are not perfect.

To expect the thing to be done every single time, every day without fail, would be unrealistic.

Also, to give yourself a hard time when you fail sometimes, will KILL your progress.

You need a system that’s easy to track, moderately flexible, and forgiving of human nature.

The way I do it, is I realize almost anything can be broken down into a binary system of ones and zeroes.

I either did the good thing (which would be a 1), or I didn’t (which would be a zero).

For negative investments, NOT doing it would be a 1, and doing it would be a zero.

E.G., If I want to do 10,000 steps a day to improve my health… …anything above 10,000 would be a 1, anything below that would be a zero.

And I track that progress…

Use a Simple Weekly Tracker

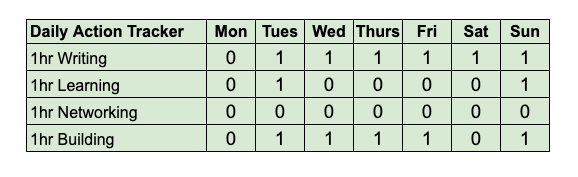

Right now, I have a plan to write for 1hr a day or more.

I also want to spend 1hr learning a new skill, 1hr building something like a product or my website, and 1hr networking with other business owners.

When broken down into daily tasks, this can be put into a grid system, and monitored really easily.

I fill this out each day as I do it, and my goal will be to get as many of those 0’s turned into 1’s.

Here’s mine from this week so far:

I had to take Monday off these tasks. It was Labor Day, and for my sales job this is a MASSIVE work day. so, I made that my top priority. These days will happen.

I was also scheduled to work Saturday, but I was still able to do my 1hr of writing that day. Today is Sunday, which has been my most productive day of the week.

You will have emergencies, and days where doing what you need to, just can’t be done

As you can see above, this week I’m having no problem writing for 1hr, and building my website is going great, too!

But, I need to figure out the right time for networking, and my learning isn’t coming along too well, either. I haven’t been networking at all, but this was a choice. I didn’t have any tweets or posts ready, and just focused on writing and building this week.

As it’s Sunday today, I will sit and figure out how to add networking & learning into my schedule better this coming week.

When you look at this at the end of the week, your goal is NOT perfection.

Know deep down in your heart, that as long as you have more 1’s than 0’s, you’re winning. Even when it doesn’t feel like it.

The Goal? Simple! Get more 1’s than Zeros Each Week

- Seven 1’s is perfection

- Four to Five 1’s is success

- Less than four 1’s, means you need to improve on that task.

If you end up with a perfect 7 on one item every week, you either can take it off (because it’s a habit now, and automatic), or up the stakes by doing more of that thing, or increase your target amount.

Review Weekly and Adjust

All I do each week, is take a quick look at my tracker, and I can instantly see where I’m winning, and losing. I know where I need to improve, or make changes to my strategy on that task.

Each week, if you have a weaker area, with more 0’s than 1’s, you know you need to focus on improving in that area.

Keep adapting until you get really good and consistent at that thing.

Focus on Actions Not Results

Don’t worry about looking at the bank account, progress, or results, until after a while. I’m certainly not looking at my website every single day and checking progress.

All you want to do is focus on building solid habits, and taking that action every day.

You’ll never save a dollar, unless you learn to save pennies.

My grandmother used to say, ‘take care of the pennies, the pounds take care of themselves’.

Over 6 months, if you have consistently produced more 1’s than 0’s on anything, you WILL be able to look back and see you’re making MASSIVE progress.

It will be IMPOSSIBLE for you to look back and see failure.

There’s just NO WAY if you keep doing more 1’s than 0’s, you can lose.

Every once in a a while, take a look at your progress.

I guarantee it will amaze you, and also give you MASSIVE motivation to continue what you’re doing.

Summary

If you want a Life by Design, you need to know where you’re going, how to get there, and take steps each day on your journey, to get to that place.

- Take a look at everything in your life today, and see that area as a bank account you’re either paying into, or not. Recognize that you might even be withdrawing, or overdrawing from that account through negative investment.

- Put together a plan of action, based on my 1’s and 0’s binary tracker, and keep track of your actions each day.

- Next, review each week, adjust, and make improvements, but understand you’re human. You will make mistakes, but a larger amount of 1’s than 0’s, means you’re still winning.

Pretty soon, you’ll be able to look back at the last 6 months and realize you’ve indeed been living a… ****

…life by design, not by default.

Thanks for reading!

I sincerely hope you find this email useful, and that you can begin to make positive changes in your life, and get it going in the direction you want it to.

In my next blog post, I’m going to be talking about the most important 4 areas of your life, that you need to focus on and balance, in order to succeed.

If even just ONE of those areas is weaker for you, it’s probably where you’ve struggled, or some things in your past haven’t worked out.

I’ll also be giving you tips on how to find more balance over all, and how you can improve on your weaker areas.

Share this blog post with a friend if you found it useful, and tell them where they need to be to become more successful, and truly live a life by design.

Speak soon,